PLANNED

GIVING

Champions Made Here

“”

Winning takes talent.

To repeat takes character.

— Coach John Wooden

What It Takes

Bruin Walk, classrooms and labs stand silent and dark. It is 6 a.m., and Drake Stadium is alive with teams sweating through drills around the track. This is morning practice, here and in other athletic venues across campus. At the end of the day, there will be another round of workouts. In between, the schedule is loaded with classes, homework, studying, papers, mid-terms and final exams.

From every break-of-dawn practice to every celebrated victory and graduation day, UCLA student-athletes build a legacy of hard work, dedication, and talent both in the classroom and on the field. But they don't go at it alone.

It All Begins With You

Standing behind nearly 700 Bruin student-athletes are alumni and friends who are creating their own enduring legacy through their long-term philanthropic support of UCLA Athletics.

What will your legacy be?

“”

Student-athletes deserve a lot of credit. It takes exceptional discipline to balance daily practices, games away from home, keeping up studies, and graduating. I believe it's very important to help these young people, to steer them in the right direction.

— George C. Halversen, '62, UCLA School of Law longtime supporter of UCLA Athletics | member of the UCLA Legacy Society

Memories Created Here

From Legends

Perhaps you remember the excitement of watching Troy Aikman lead the Bruins to a 20-4 record and go on to become a legendary quarterback. Or you were awed by Jackie Joyner-Kersee as she broke Olympic records in the grueling seven events of the heptathlon. Or you cheered Annette Salmeen as she swam toward her NCAA and Olympic medals (not to mention her other victories, a 3.95 GPA as a chemistry major and a Rhodes scholarship).

…To Future Generations

When you decide to include UCLA Athletics in your estate plans, you unlock the doors to leadership and success for young student-athletes, whether they become the next sports legends or gifted physicians, architects or CEOs.

Remembering UCLA Athletics in your will or living trust is an accessible and easy way to express your support. Special arrangements may enable you to plan a gift that will reduce taxes on your estate or to establish an endowment in your name or in memory of a loved one. Whichever option you choose, a bequest costs nothing now and yet gives you the immediate satisfaction of achieving your philanthropic goals.

“”

You can't live a perfect day without doing something for someone who will never be able to repay you.

— Coach John Wooden

How many lives will you change?

“”

My goal is to generate at least one ongoing scholarship for each women's sport. In my era, there were no collegiate athletic competitions for women at UCLA. Since then, UCLA has played a leading role in promoting athletics for women and that's what initiated my interest in this program. I believe athletics participation builds confidence and the ability to work with one another across gender, socio-economic and color lines. All this comes in addition to the delight of studying at a prestigious university. I think planned gift arrangements are a win-win: Both the school and the donor benefit. For example, annuity payments augment my income and I enjoy having a positive impact during my lifetime.

— Jody Chapman, '58 and '59, UCLA College (Physical Education), long-time supporter of Athletics and member of the UCLA Legacy Society

Legacies Built Here

UCLA Athletics provides many gift arrangement options that can help you establish a personal and permanent legacy while taking care of your own needs:

Charitable Lead Trust

An innovative way to pass on appreciating assets to loved ones while making charitable gifts and reducing estate taxes. A lead trust makes an annual payment to UCLA Athletics for a number of years, then the remaining assets go to your heirs.

UCLA Donor Advised Fund

Make a tax-deductible gift to UCLA Athletics to establish a fund and advise later on the specific use of the gift. At least half of the gift must be designated to UCLA while the rest may support other charities.

Charitable Gift Annuity

In exchange for a gift of cash or appreciated stock, you (and/or another beneficiary) receive fixed payments for life and significant tax benefits.

Deferred Charitable Gift Annuity

This arrangement allows you to delay an annuity payout date and enjoy higher payments.

Retained Life Estate

Donate your real estate property while retaining the right to live there for life and enjoy tax benefits.

Gift of Real Estate

You can make a philanthropic gift of your residence, rental or commercial property, or undeveloped land through your will. You may also use real estate to fund a gift arrangement, such as a charitable remainder trust. Tax benefits can be significant, and in some cases, donors may also receive income.

Charitable Remainder Trust

You may establish this trust for a flexible number of years, or for life, receive a substantial tax deduction plus regular (fixed or variable) payments. When the trust ends, the principal is distributed to The UCLA Foundation for the purposes you designate.

Gift of Retirement Assets

Many donors choose to name The UCLA Foundation/UCLA Athletics as the beneficiary of their retirement accounts (often the most heavily taxed portion of an estate).

Gift of Life Insurance Policy

If you have life insurance policies that are no longer needed to protect family members or a business, you can transfer them to The UCLA Foundation and name UCLA Athletics as the owner and beneficiary. In some cases, this may provide you with tax benefits.

A life is not important except in the impact it has on other lives.

— Jackie Robinson

Thank you. Your support lets us push the bar ever higher.

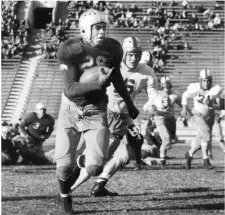

Jakie Robinson

Rafer Johnson

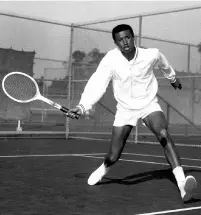

Arthur Ashe

Ann Meyers Drysdale

Jackie Joyner-Kersee

Troy Aikman

UCLA's gift planning professionals are always available to share more detailed information about UCLA Athletics gift planning and provide you and your advisors with personalized examples and illustrations. Conversations with the University's gift planning team are confidential and never imply any obligation.